In recent years, green bonds have become a powerful financial instrument, playing a key role in addressing the global challenge of climate change and funding sustainability projects. These bonds support environmentally beneficial initiatives such as renewable energy, biodiversity conservation, and sustainable infrastructure, offering both financial returns and a tangible positive impact on the environment. Despite the promise they hold, green bond prices have been lower than expected due to several market factors. However, the future of green bonds is incredibly bright, with a growing alignment between investor demand and sustainability objectives.

Understanding Green Bonds

Green bonds operate like traditional bonds but serve a higher purpose—financing projects dedicated to environmental sustainability. Governments, corporations, and institutions issue these bonds to fund projects such as renewable energy development, energy efficiency improvements, and biodiversity conservation initiatives. Green bonds provide an innovative solution to global environmental issues, allowing investors to support the transition to a low-carbon economy while securing returns.

Moreover, the market for green bonds is expanding rapidly. With governments and corporations pledging to meet net-zero emissions targets, the demand for green financing climate and nature positive instruments is expected to continue accelerating. Green bonds are thus well-positioned to become a mainstream financial tool for a sustainable future.

Why Are Green Bond Prices So Low?

Several factors explain why green bond prices have been lower recently:

Increasing Supply of Green Bonds

As the issuance of green bonds has surged globally, supply now outpaces demand in certain markets. However, this increase in supply is a positive sign that sustainability-focused financing is becoming mainstream. As more investors adopt ESG (Environmental, Social, and Governance) strategies, demand for green bonds is expected to catch up, potentially driving prices higher in the future.

Rising Interest Rates

Like all fixed-income instruments, green bonds are affected by interest rates. In a rising rate environment, newly issued bonds offer higher yields, making older green bonds less attractive. However, this is a temporary challenge. As central banks stabilize interest rates, green bonds—especially those tied to long-term climate and nature positive environmental projects—will regain their appeal.

Perceived Risk of Green Projects

While some green bonds finance projects in emerging sectors or developing regions, where risks may be perceived as higher, this is also an opportunity. Investors who understand the long-term potential of green technologies and climate and nature positive sustainability initiatives recognize that these bonds support transformative projects that can generate both environmental and economic returns.

Greenium and Market Maturity

The concept of greenium, or the premium investors have historically paid for green bonds, is evolving. As the green bond market matures and expands, greenium has diminished, making these bonds more accessible. This signals a healthy market transition, where green bonds no longer command higher prices but instead offer competitive returns, aligning with the expectations of mainstream investors.

Greenium and ESG Investment Strategies

Green bonds are increasingly attractive to investors seeking to align their portfolios with ESG goals. The diminishing greenium, while lowering bond premiums, actually enhances the accessibility of green bonds, offering competitive returns without sacrificing sustainability. As the market for green finance grows, companies with high ESG commitments, particularly climate and nature positive, are likely to attract more capital, driving even more innovation and positive environmental impact.

For investors with a long-term view, green bonds provide a unique opportunity to support projects with positive externalities while maintaining attractive returns. This alignment of financial and environmental performance makes green bonds a compelling part of any sustainable investment strategy.

A Quote on Brazil’s Green Bond Market

Green bonds have emerged as an essential tool for financing sustainable projects, significantly contributing to the transition to a low-carbon economy. In Brazil, the green bond market is still in its growth phase but already shows enormous potential. Since the first issuance in 2015, the country has accumulated around USD 11.2 billion in issuances.

The growth of this market in Brazil is driven by the increasing demand for sustainable investments, both from institutional investors and individuals concerned about the environmental impact of their investments. Additionally, the greenium, which is the price premium that investors are willing to pay for green bonds, is directly related to the supply and, more importantly, the demand for these bonds. This phenomenon is reinforced by the commitments made by large asset managers and financial institutions to direct resources towards projects that promote sustainability.

With the growing awareness of climate change and the need for concrete actions, the green bond market in Brazil has significant room for growth. The expectation is that, with favorable public policies and the continuous engagement of the private sector, we will see a substantial increase in green bond issuances in the coming years, contributing to a more sustainable and resilient future.

Quotes Marcos Lima, ESG Finance and Investment Banking – Lecturer at FEBRABAN and Coordinator of Sustainable & Climate Finance at BV Bank.

A Bright Future for Green Bonds

Looking ahead, the future of green bonds is incredibly promising. Several factors will fuel their growth:

Increasing Regulatory Support

Governments are implementing policies to promote sustainable finance, including green bonds. The European Union’s Green Bond Standard is setting the stage for stronger frameworks that ensure the transparency and integrity of green bonds. These regulations will encourage more issuers to enter the market and provide investors with confidence in the impact of their investments.

Climate Commitments and Global Demand

With global climate commitments like the Paris Agreement pushing governments and corporations to reduce carbon emissions, the demand for green finance will only grow. Green bonds are at the forefront of financing this transition, offering an efficient way to raise capital for large-scale environmental projects.

Investor Appetite for Sustainable Assets

As more investors integrate sustainability into their strategies, green bonds will continue to be a key part of the solution. The narrowing greenium makes these bonds more attractive to a broad range of investors, enabling green bonds to move from a niche product to a mainstream asset class. This growing demand, coupled with an increase in green bond issuance, is expected to drive significant market growth.

Addressing Critical Environmental Challenges

Green bonds are crucial in financing essential sustainability projects, including biodiversity conservation. As highlighted by the Kunming-Montreal Global Biodiversity Framework, an estimated $700 billion per year is needed to protect biodiversity, a funding gap that green bonds can help fill. This critical role in addressing global environmental challenges ensures that green bonds will remain central to financing the transition to a more sustainable world.

Opportunities for Investors

Now more than ever, green bonds present an exciting opportunity for investors. As greenium diminishes, investors can support impactful environmental projects while maintaining competitive yields. The alignment between Climate and Nature Positive goals and financial performance makes green bonds an essential part of any diversified portfolio, particularly as sustainability becomes a top priority for businesses and governments alike.

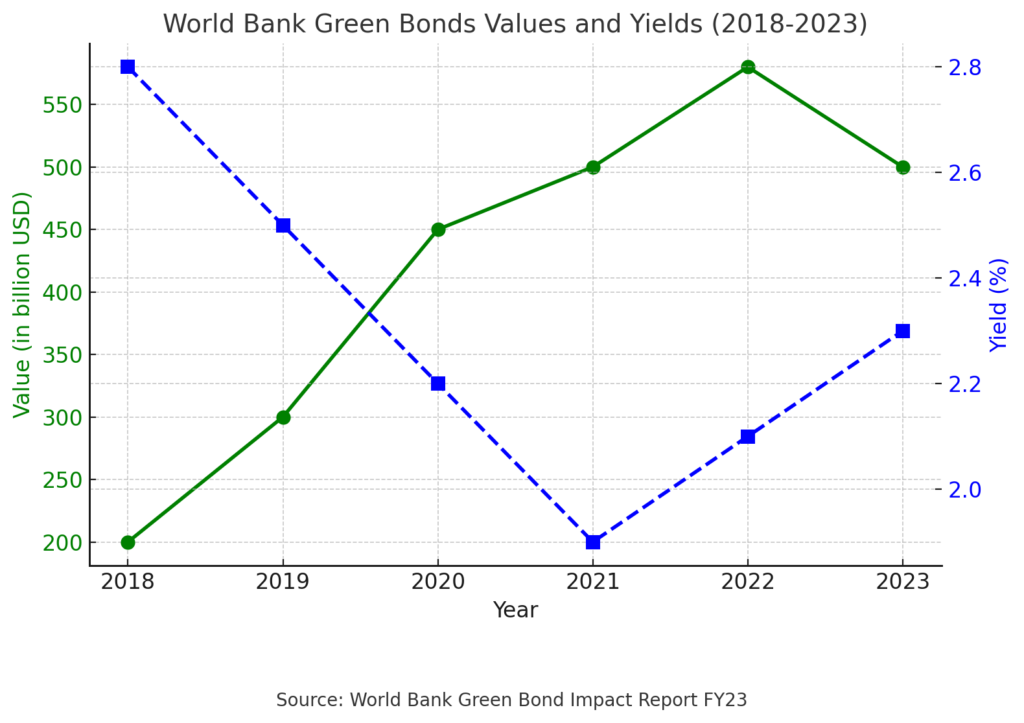

Green Bond Values and Yields

This graph illustrates the growth of World Bank green bond values and corresponding yields from 2018 to 2023. It highlights the steady rise in green bond issuance and the market yields over time.

For more detailed information on green bond values, yields, and their impact, we encourage readers to explore the World Bank FY23 Green Bond Impact Report.

Conclusion

Green bonds are more than just financial instruments—they are catalysts for change. Despite current pricing dynamics, the long-term future of green bonds is extremely bright. With strong regulatory support, growing investor demand, and increasing recognition of the need to address global environmental challenges, green bonds are poised to become a cornerstone of sustainable finance.

As the market matures, green bonds will continue to align investor strategies with climate and nature positive environmental goals, providing both financial returns and the chance to make a meaningful impact on the world. For investors and issuers alike, this is an opportunity to shape the future of sustainable finance—and the planet.

Contact us for expert advisory on aligning your business efficiently with climate and nature positive strategies and implementing effective action plans.

Related article: Mobilizing Financial Resources for Biodiversity Conservation: Challenges and Imperatives – Green Initiative – For a Climate and Nature Positive Planet

Written by Yves Hemelryck, from the Green Initiative Team.